Payment System Integration: Improving Access for Greater Inclusiveness in the Payment System

By Karl Hankey

Keys Messages

- Strategic Integration Dismantles Barriers: The Eastern Caribbean Central Bank (ECCB) is focused on breaking down traditional financial inclusion barriers through strategic partnerships.

- Comprehensive Digital Ecosystem Creates Access: The integration of traditional payment systems and fintechs has the potential to create multiple pathways for unbanked and underserved populations to access formal financial services.

- Regulatory Framework Enables Innovation: The Payment System and Services Act 2025 (passed in three member countries) and a harmonised Data Protection Bill will establish the regulatory foundation for fintech innovation across the Eastern Caribbean Currency Union (ECCU).

Introduction

Financial inclusion remains essential to the ECCB’s strategic vision for economic development across the ECCU. Traditional barriers such as geographic isolation, transaction costs, limited infrastructure, and fragmented payment systems have historically restricted participation in the formal economy. Through strategic payment system integration, the ECCB is addressing these challenges, creating pathways for broader financial participation, and developing payment systems that are effective, efficient, reliable, accessible and secure.

Creating Pathways for Inclusion

The ECCB leverages key financial market infrastructures[1] as conduits to effect transformative change in the regional payment landscape. Through strategic partnerships with established institutions such as the Caribbean Credit Card Corporation (4Cs) and the Eastern Caribbean Automated Clearing House (ECACH), the Bank is systematically expanding access to digital financial services across all ECCU countries.

Caribbean Credit Card Corporation

The Caribbean Credit Card Corporation (4Cs) commenced operations in 1994 as a principal member of major international payment networks, including Visa, MasterCard, Discover and American Express. It has unified, regionally-integrated card payment processing among financial institutions within the Organisation of Eastern Caribbean States (OECS).

The 4Cs provides a wide range of services, including card issuing and acquiring, automated teller machine (ATM), point-of-sale (POS) processing, mobile and web-based payment solutions, and automated clearing services. This comprehensive model creates a unified regional gateway, eliminating the need for individual institutions to establish separate relationships with multiple international networks, reducing costs and complexity while expanding access to global payment infrastructures.

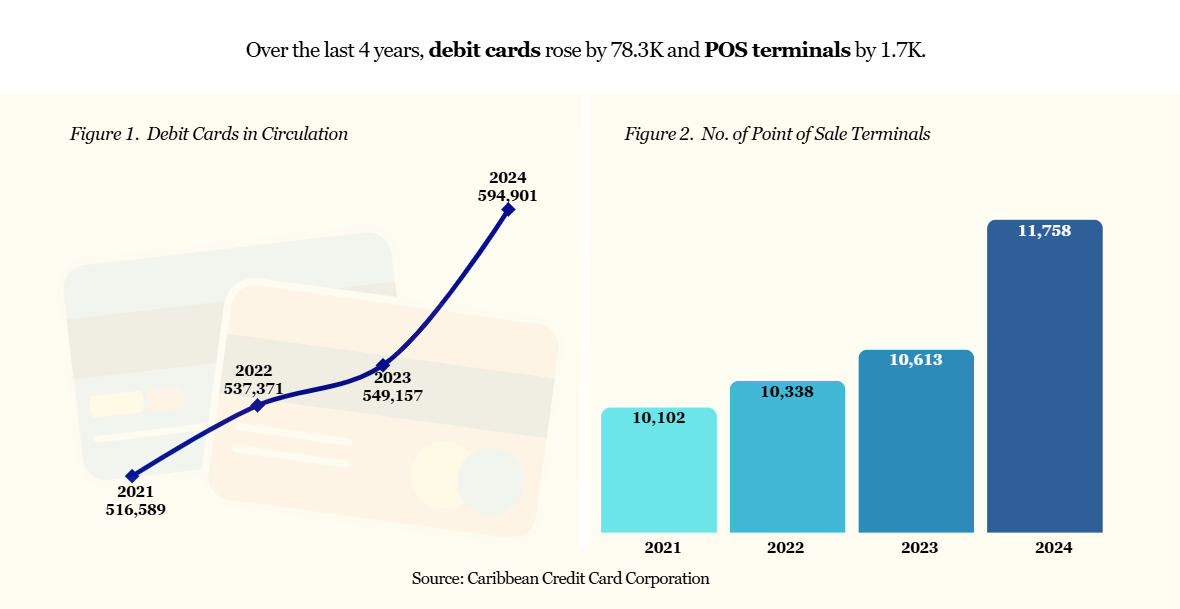

Recent data from the 4Cs highlight significant expansion of digital payment infrastructure across the region. Between 2021 and 2024, the number of debit cards in circulation grew by 15.2 per cent (figure 1), underscoring growing consumer adoption of digital payment methods. During the same period physical point-of-sale terminals accepting electronic payments grew by 16.4 per cent (figure 2), reflecting enhanced merchant acceptance infrastructure supporting greater payment accessibility.

Eastern Caribbean Automated Clearing House (ECACH)

Before the establishment of the ECACH, the regional payment landscape was characterised by significant inefficiencies. Commercial banks relied on physical cheque exchanges - a manual process that caused long settlement delays and heightened operational risks. To address these challenges, the Eastern Caribbean Automated Clearing House Services Incorporated was established in 2011 as a strategic joint initiative between the ECCB and regional commercial banks. By 2014, ECACH became fully operational, enabling electronic cheque exchanges, which significantly enhances security, processing speed, and operational efficiency.

Building on this foundation, Electronic Funds Transfers (EFTs) were introduced in 2018, enabling bank-to-bank credit transfers to be sent electronically across all ECCU member countries. This marked a crucial milestone in expanding payment options and improving financial access. For customers, EFTs mean faster fund availability (generally the same day or the next business day, depending on each institution’s cut-off times), region-wide reach, and the convenience of making payments via online banking, mobile banking or in-branch. The ECACH rules were also subsequently amended to allow other classes of institutions, including credit unions, member Governments, social security systems and corporates to participate; the goal being to extend the benefits to their customers and further democratise payment system access.

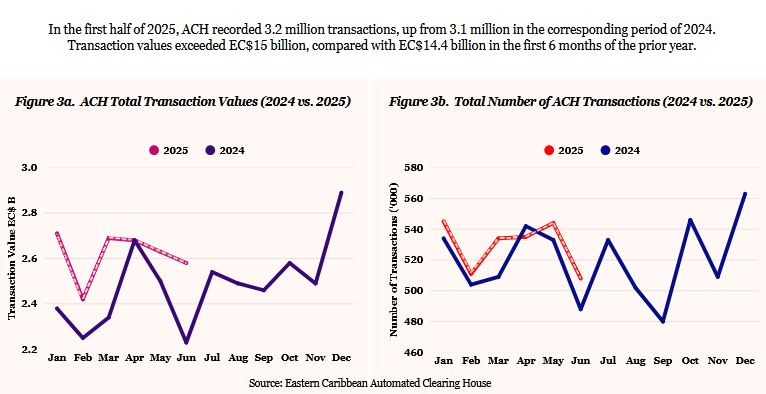

Recent ECACH data show strong growth in transaction values and volumes (figure 3), reflecting rising confidence in digital payment solutions and advancing the region’s financial inclusion objectives.

ECACH is positioned for continued evolution with planned direct debit services and the implementation of an Instant Payment System (IPS). These enhancements will further modernise the region's payment landscape, expand payment options, reduce processing delays and promote broader participation in the formal financial ecosystem.

A New Era of Payments: Digital Innovation and Instant Systems

Instant Payment System (IPS)

In collaboration with the ECCB, ECACH is implementing an IPS across the ECCU - a critical step in the region’s digital transformation. The system represents critical advancement in enhancing payment accessibility, convenience and financial inclusiveness. The IPS will facilitate real-time interbank payments, enabling immediate transfers for consumers, merchants and financial institutions across all ECCU countries.

The CARICOM Payments and Settlement System (CAPSS)

CAPSS is a region-wide initiative amongst central banks, that is aimed at improving how money moves within CARICOM member states, enabling faster, lower-cost cross-border retail and wholesale payments; hence reducing reliance on international correspondent banks. Modelled after the Pan-African Payments and Settlement System, this project has progressed from exploration to a successful proof-of-concept (POC) led by the Central Banks of Barbados and The Bahamas. The POC demonstrated the feasibility of CAPSS adding a new domestic and cross-border payments mechanism, allowing customers from local banks to conduct real-time transactions with customers from any other country in the region using only their local currency. The next step is a multi-country pilot spanning Barbados, The Bahamas and two (2) additional jurisdictions, finalising agreements, establishing governance arrangements and on-boarding system participants for launch. With interoperability and real-time rails at its core, CAPSS is positioned to unlock new trade flows across the Caribbean and strengthen commercial links.

DCash: Pioneering Central Bank DigitalCurrency

In March 2021, the ECCB launched the DCash Pilot, testing a retail Central Bank Digital Currency (CBDC) across all eight ECCU countries. DCash directly supports financial inclusion by providing accessible payment options without requiring traditional banking relationships, enabling unbanked populations to participate in the digital economy. The pilot enabled person-to-person (P2P), person-to-business (P2B), and business-to-business (B2B) payment flows.

Fintech Innovation: Expanding Access through Technology

Fintech companies play a crucial role in advancing financial inclusion by offering innovative solutions that complement traditional banking services. These entities provide accessible, user-friendly digital payment platforms, mobile money services and alternative lending solutions that reach underserved populations, particularly the unbanked. Through the Payment System and Services Act, 2025 (PSSA/the Act) regulatory sandbox provisions, fintechs can test innovative payment solutions in controlled environments, enabling rapid deployment of services that address specific financial inclusion challenges. Fintechs can extend the reach of formal financial services to remote areas and underserved communities, creating additional touchpoints for digital payment adoption.

Regulatory Foundation: The Payment System and Services Act, 2025

The PSSA will replace and repeal the 2008 Payment System Act. The Act has been passed into law in Antigua and Barbuda, Grenada and Saint Lucia, marking significant progress toward regional implementation.

Key enhancements include modern payment definitions, consumer protection, structured licensing for payment service providers and strengthened ECCB oversight powers. It also facilitates regulatory sandbox provisions for fintech innovation while mandating system interoperability. Fintechs are positioned through PSSA provisions to address financial inclusion challenges by offering innovative solutions complementing traditional banking.

The ECCB is collaborating with the OECS Commission to develop a modern, harmonised Data Protection and Privacy Bill for the ECCU. This legislation will establish robust safety standards including personal data protection, financial information security, consumer privacy rights and secure cross-border data transfers. Enhanced data protection is expected to increase consumer confidence, drive digital payment usage, encourage fintech innovation, and support technological advancement.

Call to Action

- Payment system integration is central to the ECCB's financial inclusion strategy. The transformation from fragmented, manual processes to an interconnected electronic ecosystem demonstrates how strategic integration breaks down traditional barriers and democratises financial services. To build on this progress, the region should: Accelerate Legislative Adoption: The remaining five (5) ECCU member countries must prioritise passage of the Payment System and Services Bill, 2025 to achieve complete regional harmonisation of the regulatory framework.

- Embrace Digital Payment Solutions: Financial institutions, businesses, and individuals should actively adopt digital payment methods while supporting public education initiatives to address cultural barriers and promote digital payment literacy across all communities.

- Support Fintech Integration: Stakeholders across all sectors must collaborate to create a safe enabling environment for fintech innovation across all ECCU member countries.

Growth in the volume of transactions at the ECACH, expanding infrastructure of 4Cs and planned IPS demonstrate that integration creates economies of scale while lowering costs. These systems ensure that geographic boundaries no longer limit financial service access, enabling full participation in the formal economy across the ECCU. While significant progress has been made, continued effort is essential. Access to modern financial services remains a critical enabler to financial and economic development, and the ECCB remains committed to advancing payment system modernisation and inclusion for the good of the people of the currency union.

WE WOULD LIKE TO HEAR FROM YOU!

We value your thoughts! To help us make this blog series even better, we’ve put together a very short survey—just five quick questions. Your feedback will help us create more content that’s relevant, engaging, and useful to you. It will take no more than two minutes. Click here to access the survey. Thank you for being part of our community!

---

About the Eastern Caribbean Central Bank

The Eastern Caribbean Central Bank (ECCB) was established in October 1983. The ECCB is the Monetary Authority for Anguilla, Antigua and Barbuda, the Commonwealth of Dominica, Grenada, Montserrat, Saint Christopher (St Kitts) and Nevis, Saint Lucia and Saint Vincent and the Grenadines.

Disclaimer

The ECCB strongly supports academic freedom and encourages such activity among its employees. Notwithstanding, the views and opinions expressed are solely those of the authors. The ECCB may not necessarily endorse the writers’ position or guarantee technical accuracy. Readers are free to submit their comments or questions on the information presented in this publication.

[1] Financial market infrastructure refers to systems and entities involved in clearing, settlement, and the recording of payments, securities, derivatives, and other financial transactions (Wikipedia, 2025).