Supply Chain Resilience – An Imperative for the ECCU

Key Messages

- The global supply chain has been impacted by the COVID-19 pandemic with disruptions and increased risks and costs. This situation is now exacerbated by the war in Ukraine.

- These disruptions point to the need for greater attention to be given to building resilience in and shock-proofing the regional supply chain.

Global Supply Chain Shocks and Disruptions

On 23 March 2021, traffic through the Suez Canal ground to a halt causing a backlog of container ships from Asia to Europe and giving way to another round of uncertainty in the global supply chain. This followed on the disruptions and pressures arising from the fallout caused by the worldwide spread of the coronavirus. Global supply chain crisis is not new. The global supply chain has been impacted over the years by various factors such as a shortage of inputs and fuel, wars and geopolitical tensions, and climatic conditions. However, never has the supply chain been more tested than now, due to the COVID-19 pandemic. The global pandemic has revealed the fragility of the supply chain and the resulting impact on our lives and livelihoods.

The war in Ukraine has led to rising prices and potential shortages for food and fertiliser globally, which pose a threat to food and nutrition security in the ECCU. The FAO Food Price Index (FFPI) averaged 158.5 points in April 2022, which was 29.8 per cent above its value in the corresponding month last year. Since March, crude oil prices on average have continued to trend upwards over US$100 a barrel.[1] Predictions are that prices will increase by 55 per cent in 2022.[2] Given the high dependence of the ECCU on food and fuel imports and the global significance of both Russia and Ukraine in the export of these commodities, the inflationary impact in the ECCU is expected to be significant. In 2021, consumer prices in the region increased by 2.0 per cent on a period average basis. Early estimates by the ECCB predict inflation increasing in 2022, to approximately 4.0 per cent. Average prices for gas and LPG in April 2022 showed an increase of 18.6 per cent and 3.74 per cent compared to the corresponding period in 2021 (see Figure 1).

Figure 1: Average Gas and LPG Prices in the ECCU

ECCU Member Countries Not Immune

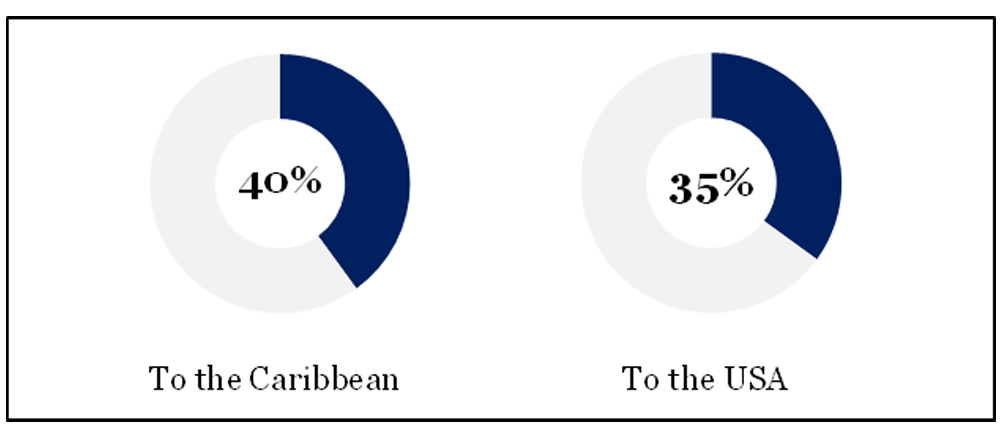

As members of the global economy and participants in global trade, the ECCU has not been spared. Images of shopping carts filled high with toilet paper, supermarket shelves emptied out of some necessities and long queues outside retail establishments, are still fresh in our minds. ECCU trade data for 2020 show that we imported US$2 billion in goods, largely from the USA, Trinidad and China (see Figure 2). Our exports are largely to the Caribbean (40.0 per cent) and the USA (35.0 per cent) (see Figure 3). With such a trade position, it is clear that the region faced the fallout from the pandemic.

Figure 2: ECCU Import of Goods

Figure 3: ECCU Exports (2020)

In the early days of the pandemic, businesses faced both supply and demand shocks to their value chains as a result of inbound logistics challenges. Governments, businesses and individuals all faced difficulty in procuring goods, such as medicine, medical equipment, personal protective equipment (PPE) and equipment for infrastructure maintenance. The supply chain disruptions affected sectors, such as: Agriculture and Fisheries, Retail, Manufacturing, Transportation, Tourism and Construction. The disruptions were due to the inability to mobilise the workforce and connect to target markets - arising from border closures, quarantines, and grounded airlines and cruise lines. With border closures and national lockdowns, consumer demand, shopping behaviour and patterns also changed. Demand variability is one of the conditions that give rise to supply chain vulnerability.

Responding to the Challenges

There is now an intensified need to rethink strategies of bringing in supplies and distributing to consumers within countries, and to establish contingency plans for periods of crisis.

Businesses should analyse their supply chain, identify risks and vulnerabilities, consider onshoring production while diversifying their base. But how can small island states - like those of the Organisation of Eastern Caribbean States - design their supply chain to be more resilient and diverse? For the most part they are not able to bring home the production of manufactured goods. How can regional businesses and consumers respond?

They must engage in a deep dive and holistic review of their supply chain. They must engage in ongoing risk management and demand analysis as well as build in enough operational flexibility to protect against future disruptions. Analysis of the supply chain will help identify where changes might be necessary and what action can be taken to mitigate disruptions. They must grasp the opportunity to form new partnerships, vertical integration and clusters for suppliers and stakeholders. They must make greater use of technology, including blockchain to the extent feasible, and innovation to build efficiency, resilience and adaptability in their supply chain; to have access to real-time information so as to reduce uncertainty and allow the parties to make informed decisions. Greater use must also be made of existing trade and information portals.

Figure 4: A Holistic Approach to Supply Chain Resilience

In the ECCU, we depend heavily on imported food, thus it is also an opportunity for consumers and businesses to embrace the idea, where possible, of “buy local”. This would give the opportunity for increased agricultural production and agro-processing, and an opportunity to enhance food security, thus reducing the food import bill. It is also the opportune time to bring to the fore and seek to remove our transportation challenges for intra-regional trade. Fast ferry linkages and a distribution trading company may be paths to relook and pursue. Solving the long-standing sea transportation constraints to boost the agriculture trade within the region, must be a priority if the regional target of reducing the food import bill by 2025 is to be met. Indeed, the recent announcement of an initiative to establish a Guyana-Barbados Food Terminal and a ferry service in the Caribbean Community (CARICOM) is an encouraging step in this direction.[3]

Enhancing Food Security; Reducing Dependency on Imports

At the beginning of the pandemic, Executive Director of the Caribbean Agriculture Research and Development Institute (CARDI), Barton Clarke, highlighted the need for the Caribbean to produce its own food, promote healthy food consumption and look towards import substitution. Farmers and home gardeners alike should ramp up the production of a variety of crops. Cultivators may require training in modern agricultural practices such as hydroponics and vertical farming, and in agro processing. Farmers can also reduce food waste through use of technology and mobile applications to reach customers. They can employ agro processing and preservation techniques, which can increase the shelf-life of produce.

In the construction industry and light manufacturing sector, we can recycle and repurpose our discarded materials. In the landscaping sector, for instance, old and used tires can be repurposed for fencing, farming and reefing. Scrap metal can be used in the construction and metalwork sectors for new products, thereby reducing the reliance on imported items. Customers can be incentivised to save, submit and reuse items. Unwanted and recovered items can be repurposed or retooled for new uses.

In the energy sector, the move should be towards resilience by making greater use and increasing investment in renewable energy, thereby reducing the dependence on imported fossil fuel.

In every sector, there will be pockets of opportunities that can be fleshed out to reduce the reliance on the supply chain for imported goods. Necessity, particularly in a crisis, often brings out the innovativeness and creativity of a people.

Role of Private Sector and Government

The private sector must engage in crisis management training, and Strengths, Weaknesses, Opportunities and Threats (SWOT) analysis and scenario testing of how to restructure the supply chain. Guests on Baker McKenzie Podcast Series on Resilience, Recovery and Renewal[4] state that, in addition, firms must use technology to monitor product information, supply, source and availability, while ensuring data access and security.

At the same time, governments have a role to play in shock-proofing the regional supply chain by creating the right business environment with the necessary legal and regulatory framework to attract onshore production. They can engage in the following:

- Ensure that laws for labour relations and contracts are modernised and meet international standards;

- Put in place frameworks for intellectual property rights, trademarks and patents; and

- Be clear on which firms are essential and how they are linked to the rest of the economy.

Now is the opportune time for regional integration of the supply chain eco-system and a cohesive logistics management strategy. This new paradigm lends itself to creative and innovative opportunities for diversification of the supply chain, one product at a time.

Call to Action

As a region, it is imperative that we capitalise on opportunities for strengthening the resilience of the region’s supply chain, while reducing our dependence on imports. This requires a whole of society approach for engaging in the following:

- Fast ferry and requisite logistics to distribute food across the region from the food rich to the food poor;

- Support regional energy initiatives: OECS Solar Energy Challenge – Race 2 the Sun; ECCB Renewable Energy Infrastructure Investment Facility;

- Increase awareness of the food-health link and increase intake of local produce;

- Make greater use of climate-smart agricultural techniques; and

- Massive buy local campaign with strong messaging and incentives.

- https://fred.stlouisfed.org/series/DCOILWTICO; https://fred.stlouisfed.org/series/DCOILBRENTEU

- World Economic Outlook, April 2022: War Sets Back The Global Recovery (imf.org)

- Ali, I. (8 April 2022). Remarks delivered at Launch of the CARICOM Agri-Investment Forum and Expo. Available at: https://www.youtube.com/watch?v=Y5FqZQGZb5s

- https://www.bakermckenzie.com (episode #2 – Mattias Hedwall and Christina Conlin; episode #8 –Anne Petterd and Ben Simpfendorfer)

Acknowledgement

The ECCB acknowledges the contribution of Ms Karen Williams, Senior Project Specialist, Governor’s Immediate Office, in the preparation of content for this blog.

About the Author

Timothy N. J. Antoine has been the Governor of the ECCB since February 2016. He is passionate about the socio-economic transformation of the Eastern Caribbean Currency Union (ECCU) and is a strong advocate for regional cooperation and collective action. Indeed, he regards them as critical to shared prosperity for the people of the ECCU.

About the Eastern Caribbean Central Bank

The Eastern Caribbean Central Bank (ECCB) was established in October 1983. The ECCB is the Monetary Authority for: Anguilla, Antigua and Barbuda, Commonwealth of Dominica, Grenada, Montserrat, Saint Christopher (St Kitts) and Nevis, Saint Lucia and Saint Vincent and the Grenadines.