ECCU: Grappling With Inflation

Introduction

A confluence of factors, including developments related to the COVID-19 pandemic and Russia’s war in Ukraine and related sanctions, has contributed to elevated commodity prices internationally and the highest inflation[i] rates in a generation, across economies (large and small). The Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva, indicated that global inflationary pressures are expected to persist as long as the war in Ukraine continues.

Figure 1 highlights the impact of this phenomenon on the ECCU’s major trading partners. The UK recorded a 40-year-high inflation rate of 9.4 per cent for June 2022 and the Bank of England (BOE) projected that this rate will exceed 13.0 per cent by year-end. According to the Bureau of Labor Statistics, consumer prices in the USA rose by 9.1 per cent in June 2022 (year-on-year), driven largely by higher energy and food costs. This increase led to three consecutive rate hikes of 75 basis points by the Federal Reserve (the US central banks) - the largest since 1981. The target rate is now 3 per cent to 3.25 per cent. Only six months ago, that same rate was 0.0 – 0.25 per cent.

Bank of England and Bank of Canada among others have also significantly raised interest rates. These hikes by Advanced Economies make borrowing more expensive for their citizens. For example, a 30-year mortgage rate in the USA has now risen to 6.4 per cent. This has direct implications for the disposable income of potential tourists to the ECCU. Indeed, the US economy is slowing and the probability of a US recession in 2023 is now 50 per cent. That said; we do not project a recession in the ECCU in 2023. Current growth projection is about 5 per cent, but may be revised downwards.

At this time, there is no rise in mortgage rates in the ECCU. These rates are determined by competition among the financial institutions and that competition is fierce. Average rate for a 20-year mortgage in the ECCU ranges from 6.0 per cent to 8.0 per cent.

Most of the debt of ECCU governments (about 85 per cent is denominated in US dollars) and many debt contracts have fixed interest rates, thereby insulating them from the effects of the current rate hikes. However, where interest rates in sovereign debt contracts are tied to international benchmarks, debt servicing is becoming expensive.

This issue of rising debt servicing costs is a major concern for Emerging Market and Developing Economies (EMDEs) and some are likely to find themselves in debt distress as early as 2023.

It is important to note that the Eastern Caribbean Central Bank (ECCB) is not raising interest rates because most of the inflation in the ECCU is imported inflation so the citizens and residents of the ECCU must rely on the major central banks, especially the Federal Reserve, to bring down inflation.

Figure 1: Monthly Inflation Rates in Selected Advanced Economies

(12-month percentage change)

Consumer Prices in the ECCU

Transmission of inflationary pressures is expected, given the openness of the ECCU economy. Consumer prices in the region (Figure 2) are on an upward trajectory, driven by the costs of fuel and light, and basic food items, as supply-side issues persist. It should be noted that prices at the pump would be even higher were it not for subsidies by ECCU governments. For example, the price of the 20-pound LPG cylinder in Saint Lucia is retailing at $45.27. Without the government intervention, the price would be $65.

Figure 2: ECCU Quarterly Inflation Rates

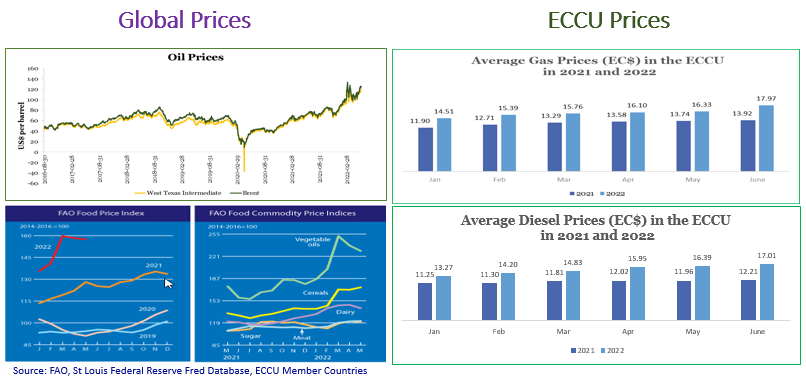

Geo-political tensions have resulted in an oil price shock (Figure 3), which drives the cost of fuel and related products. On average, petroleum products account for over 14.0 per cent of ECCU’s total imports and 92.0 per cent of its electricity generation mix. Additionally, fuel-related expenditure represents 28.0 per cent of our consumer price index (CPI) basket compared with 19.0 per cent towards food.

Figure 3: Oil and Food Prices

Given the proportion of energy and food in ECCU’s expenditure, related price shocks have inflated the overall cost of living and reduced households’ purchasing power (Figure 4). Low-income families are feeling the brunt. Many of them have been plunged into poverty thereby eroding progress towards achieving the Sustainable Development Goal (SDG) of ending poverty.

Figure 4: Impact of Inflation on ECCU Households

ECCU Food Imports

We in the ECCU import about 80 per cent of the food we consume. Since 2012, the value of food imported into the ECCU has topped EC$1 billion per annum, with the top three categories being meats, grains (such as cereals) and fruits and vegetables (Figure 5). Shortages in grains and animal feed mean higher prices for meat products, which have led to higher import bills. Likewise, considering the rise of the Food and Agriculture Organization (FAO) index for cereals and the skyrocketing prices for fertilizer - a necessary input for food production - cereals, fruits and vegetables become more expensive, further inflating the value of imports.

Figure 5: ECCU Food Imports

Fertilizer production and supply have declined, as factories face high input costs, sparking concern over future harvests and food security. In response, China has implemented restrictions to safeguard domestic demand, which has drastically reduced its export of fertilizer. The invasion of Ukraine and the effective blockade of exports from Ukraine by Russia have really exacerbated the situation. There are reports of the price of fertilizer rising from between 40 -100 per cent in some ECCU countries.

What are we Doing?

The ECCU joins CARICOM in efforts to reduce its ‘food import bill’ by 25.0 per cent by 2025, while simultaneously ensuring the region’s food and nutrition security. Despite some progress in 2021, current price developments do not augur well for achieving this target (Figure 6). Notwithstanding, we cannot give up! The import bill needs to be reduced while enhancing our food and nutrition security. We must support initiatives like Helen’s Daughters to bolster domestic food production.

Figure 6: Towards 2025

The ECCB, through its Campus greening project, produces 70 per cent of its electricity from Solar PV and is on track to generate 100 per cent by end of this year (2022), with the addition of battery storage. ECCU governments are attempting to cushion the effects of the high prices by, inter alia, placing caps on or subsidizing the fuel price at the pump and LPG, incentivizing public transportation, enhancing social safety nets, granting tax incentives to contain costs of landed goods and price control on some basic food items. They are also taking steps to incorporate more renewables into their grids. Noteworthy, Montserrat is progressing towards 100 per cent renewables by 2030.

A Call to Action

Given the gravity and urgency of the current situation, our response to this inflation shock requires collective action and sacrifice by all.

- The major central banks must get inflation under control in the shortest possible time. This process will be painful, as it will likely cause a recession - hopefully, short-lived.

- The international community must work with Russia to end its invasion of Ukraine.

- Governments must continue to cushion the effect of inflation especially on the most vulnerable. They must also work with businesses (to avoid pass through) within their fiscal means.

- Businesses must not engage in price gouging and, wherever evidence of that is found, must be firmly dealt with.

- Labour unions must temper demands for salary increases having regard for the efforts of governments to cushion the effect on the population including their members.

- Energy must be conserved and utility companies must step up advocacy in this area with helpful tips.

- The transition to renewables must be accelerated. Solar PV remains the lowest hanging fruit while geothermal and other sources are pursued.

- We must plant and eat more local food. This means we have to cultivate a taste and zest for more local food. This also means governments continuing to work with our farmers to make local food more affordable. This is not a simple task but it is an essential one.

Table 1: Collective Action and Shared Sacrifice in Addressing Inflation

[i] The IMF defines inflation as “the rate of increase in prices over a given period of time.”

Acknowledgement

The ECCB acknowledges the contribution of Mrs Beverley Labadie, Senior Policy Analyst, Governor’s Immediate Office, in the preparation of content for this blog.